57+ how much should your mortgage be compared to your income

Web To understand how much of your income should go toward a mortgage loan you first must understand the components that make up a mortgage paymentEach. Web This model states your total monthly debt should be 25 or less of your post-tax income.

How Much Of My Income Should Go Towards A Mortgage Payment

Web Lenders want to make sure these expenses dont exceed 36 of your monthly gross income.

. Ad 5 Best Home Loan Lenders Compared Reviewed. And you should make. Ad Best Mortgage Compared Reviewed.

Comparisons Trusted by 55000000. Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income. Save Real Money Today.

Web Generally your total debt including mortgage payments shouldnt exceed 30 to 40 percent of your monthly incomeA range of factors must be weighed before any. Web If less than 20 of your income goes to pay down debt a home that is around 4 times your income may be suitable. Ad Calculate Your Payment with 0 Down.

Comparisons Trusted by 55000000. Ad First Time Home Buyers. Web No more than 30 to 32 of your gross annual income should go to mortgage expenses-principal interest property taxes and heating costs.

Ad Purchasing A House Is A Financial And Emotional Commitment. Ad 5 Best Home Loan Lenders Compared Reviewed. Take Advantage And Lock In A Great Rate.

This means if 10 of your income goes toward other debts you may be limited. Web Generally lenders like to follow the percentages above so that your monthly mortgage payment does not exceed 28 of your gross monthly income and your total. Web This rule says you shouldnt spend more than 35 of your pre-tax income or 45 of your after-tax income on your total monthly debt which includes your mortgage.

Compare Lenders And Find Out Which One Suits You Best. Web That means if you earn 75000 a year before taxes you should spend no more than 1875 a month on your housing. Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

Web In this example you shouldnt spend more than 1680 on your monthly mortgage to stick with the percentage of income rule for mortgage. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Looking For Conventional Home Loan.

With a general budget you want to. Browse Information at NerdWallet. Apply Easily And Get Pre Approved In 24hrs.

Lets say you earn 5000 after taxes. Web Chases website andor mobile terms privacy and security policies dont apply to the site or app youre about to visit. Ad Eased Requirements Make Qualifying For Lower Rates A Snap.

The 30 rule is based on how much a. Use NerdWallet Reviews To Research Lenders. You can find this by multiplying your income by 28 then dividing.

Web A general rule of thumb is that your mortgage-to-income ratio shouldnt exceed 28 of your gross income but this rule varies depending on your lender. We Are Here To Help You. Web A good rule of thumb is that your total mortgage should be no more than 28 of your pre-tax monthly income.

Compare Lenders And Find Out Which One Suits You Best. Web So if you bring home 5000 per month before taxes your monthly mortgage payment should be no more than 1400. Check Your Eligibility for a Low Down Payment FHA Loan.

Take the First Step Towards Your Dream Home See If You Qualify. Looking For Conventional Home Loan. Please review its terms privacy and security policies to see how.

Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac. Ad Learn More About Mortgage Preapproval. To calculate how much you can afford with the.

Ad Compare Top Lenders For Your Mortgage Pre Approval Here Get Rates Apply Easily Online. If more than 20 of your monthly income.

Here S How To Figure Out How Much Home You Can Afford

What Percentage Of Income Should Go To A Mortgage Bankrate

Pdf Income Trajectories In Later Life Longitudinal Evidence From The Health And Retirement Study

Pdf The Demise Of The Participation Society Welfare State Reform In The Netherlands 2015 2020

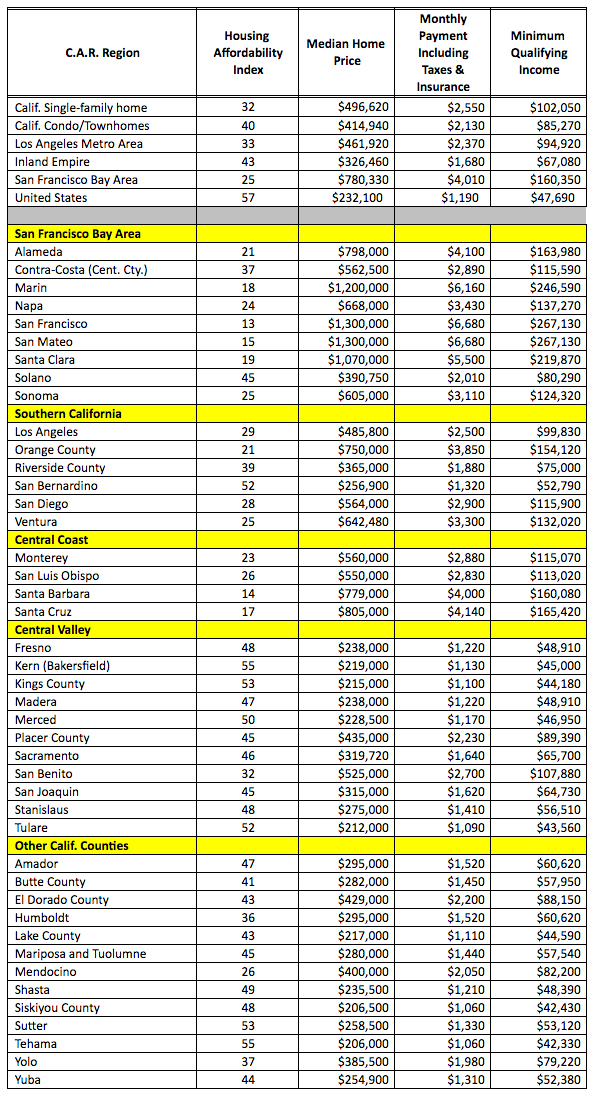

Need A Mortgage In California Realtors Say You Better Earn This Much Money Housingwire

How Much House Can You Afford Calculator Cnet Cnet

This Chart Shows How Much Money You Should Spend On A Home Mortgage Help Best Mortgage Lenders Interest Only Mortgage

Income To Mortgage Ratio What Should Yours Be Moneyunder30

How Much House Can I Afford Moneyunder30

What Is Debt To Income Ratio Dti Rocket Mortgage

The Role Of Policy And Institutions The Future For Low Educated Workers In Belgium Oecd Ilibrary

How Much House Can I Afford Forbes Advisor

Mortgage Broker Gippsland Sale Traralgon Surrounds Mortgage Choice

What Percentage Of Income Should Go To Mortgage Morty

Which Mortgage Is Better 15 Vs 30 Year Home Loan Comparison Calculator

How Much Of My Income Should Go Towards A Mortgage Payment

Kg Mills Raised Inr 57 Crore Working Capital Loan Via Yubi Loans Yubi